The Securities and Exchange Board of India (SEBI) is aiming to empower investors with clearer information about mutual fund risks. On Thursday, SEBI proposed a series of changes designed to improve the clarity and standardization of risk disclosure for mutual fund schemes.

Introducing a Color-Coded Risk-o-Meter

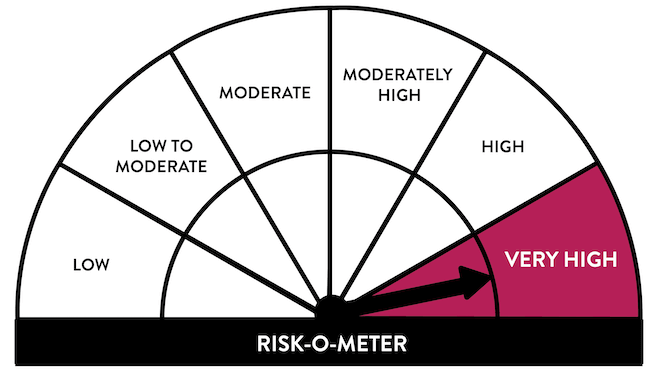

One key proposal is the introduction of a color-coded risk-o-meter. This visual representation will complement the existing risk labels (low, low to moderate, moderate, moderately high, high, and very high) with a corresponding color scheme. This is intended to make risk levels even more easily identifiable for investors. Here’s the proposed color breakdown:

- Green: Low Risk

- Chartreuse: Low to Moderate Risk

- Neon Yellow: Moderate Risk

- Caramel: Moderately High Risk

- Dark Orange: High Risk

- Red: Very High Risk

Standardizing Risk-o-Meter Disclosure

To ensure transparency and facilitate comparison, SEBI is proposing a standardized format for disclosing changes in risk-o-meter levels. Mutual funds will be required to present both the existing and revised risk-o-meter readings whenever the risk profile of a scheme or its benchmark changes. This will enable investors to clearly understand the extent of the risk shift.

Enhanced Communication with Investors

Timely communication is crucial for informed decision-making. SEBI proposes that any changes in risk-o-meter levels should be communicated to unitholders through multiple channels, including a formal notice and an e-mail or SMS alert. This will ensure investors are aware of potential changes in their investment’s risk profile.

Separate Disclosure for Direct and Regular Plans

Recognizing that direct and regular plans for mutual funds have different expense ratios, returns, and yields, SEBI proposes a standardized format for disclosing this information. This will allow for clear and easy comparison of the cost and returns associated with each plan type.

Benefits of These Proposals

The proposed changes are expected to benefit investors in several ways:

- Improved understanding of risk: The color-coded risk-o-meter and standardized disclosure format will make it easier for investors to assess the risk profile of a mutual fund scheme.

- Enhanced awareness of changes: The communication of risk-o-meter changes through notices and alerts will help investors stay informed about potential shifts in their investments’ risk levels.

- Informed decision-making: Investors will be better equipped to make informed investment decisions based on a clear understanding of both the risk profile and the cost structure of different plan options.

Next Steps

SEBI has issued a consultation paper outlining these proposals. This paper is open for public feedback until a specified date. By incorporating feedback from stakeholders, SEBI aims to finalize a comprehensive framework that promotes informed decision-making and investor protection in the Indian mutual fund industry.

Additional Considerations (Word count reached, additional points can be elaborated upon if desired)

- The impact of these proposals on the mutual fund industry, including potential implementation challenges.

- The role of financial advisors in educating investors about risk and navigating the new risk disclosure format.

- Potential future developments in investor protection and risk disclosure within the Indian financial market.

By implementing these proposed changes, SEBI aims to provide Indian investors with the tools and information they need to make informed investment decisions and navigate the dynamic world of mutual funds.

Read more:Moneycontrol Pro Panorama | What is your money chasing today?

GIPHY App Key not set. Please check settings